GST due dates have been revised again!!!

In order to provide relief to businesses, the government had extended the due date for filing GST returns.

Generally, the due date for filing GSTR 1 for monthly return filers is the 11th of the following month and for quarterly return filers it is the last date of the following month after the end of the quarter. Due date for filing GSTR 3B is the 20th day of the following month.

As a relief to taxpayers there is relaxation on late fees and penalties. Late fees have been Waived off for both GSTR 1 & GSTR 3B if returns are filed on or before revised due dates.

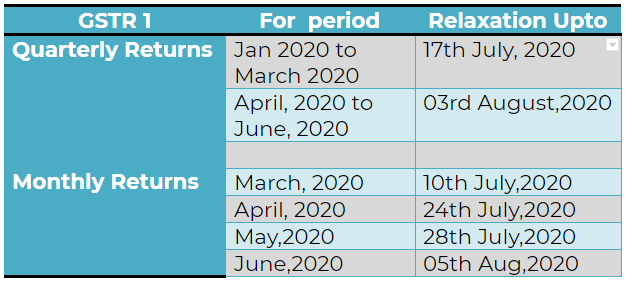

Relaxations for GSTR – 1

The revised due dates for filling GSTR 1 for both monthly (March 2020 to May 2020) & Quarterly return (Quarter ending 31st March, 2020) is as follows-

Note: In GSTR 1, Late Fees of Rs.50/- (CGST & SGST each) may apply from the original due date till the date of filing the return if return is not filed before the revised due date.

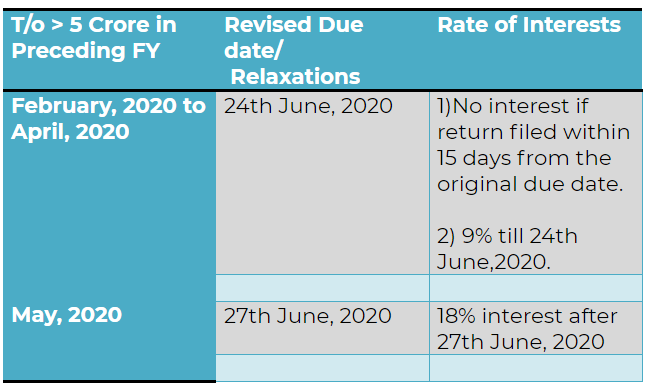

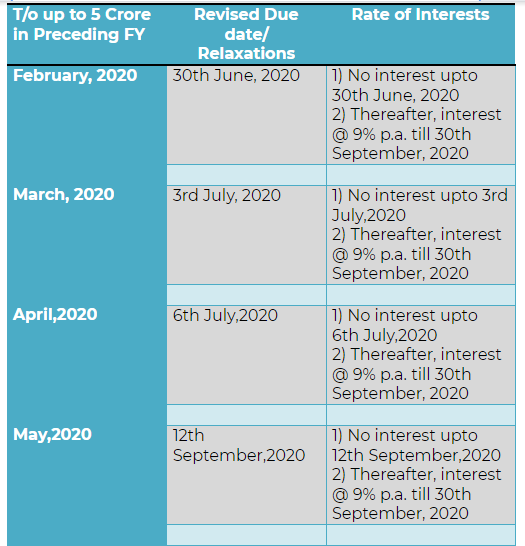

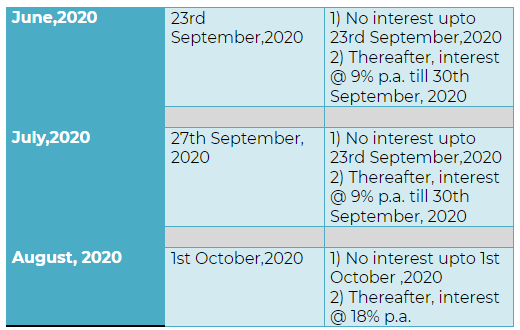

Relaxation for GSTR – 3B

For taxpayers whose turnover is up to Rs. 5 Crores/-, as far as filing of GSTR 3B and payment of tax is concerned, there is no interest if returns are filed on or before revised due dates.

For taxpayers whose turnover is more than Rs. 5 Crores/- there will be no interest if tax is paid and GSTR 3B is filed within 15 days from the original due date of filing returns. Thereafter, there is relaxation of 9% on Interest if tax is paid and return is filed on or before revised due dates.

Note of Caution

If a taxpayer missed the revised due date as mentioned in above tables the levy of interest at 18% per annum shall be payable from the revised due date of return. In addition, regular late fee shall also be leviable for such delay along with liability for penalty. There is lack of clarity from department on whether late fees will be calculated from original due date or revised due date.

For eg., if your turnover is less than Rs. 5 Crores and if you pay tax and file return of February 2020 on or before 30th June,2020 there will be no liability for interest and late fees. However,if you miss this due date and file your return on 15th July,2020 interest @ 9% p.a. will be charged from 1st July,2020 to 15th July,2020.

However if you file on 15th October, 2020 i.e. after September 2020 interest @9% p.a. will be charged from 20th March,2020(i.e. Original due date of filing February month’s return) till 30th September, 2020 and interest @18% p.a. will be charged from 1st October till the date of filing the return. Additional late fees at the rate of 100 Rs. per day may also be imposed from 20th March, 2020 till 15th October, 2020.

Although there is relaxation to some extent. However, if you miss the revised due dates the interest and late fees imposed will be substantial.

Hence, it is advised that taxpayers file their GST returns well before revised due dates.

We understand that above is a little complex to comprehend. However,we have tried our best to simplify it as much as possible. In case of any queries you can reach out to us through Ask a Query tab.

By CA Jigar Shah & Ms Hemanshi Chothani